Download the app - Your gateway to joining and managing your Hilton Honors Debit Card.

Earn up to 10,000 Hilton Honors Bonus Points with the Hilton Honors Debit Cards¹

Earn Points daily.

Unlock Gold status instantly.²

Earn up to 4.5 Points per £1 spent with your Hilton Honors Debit Card. Redeem Points for hotel stays, enjoy instant status upgrades, and save on FX fees abroad.

Sign up - Pick your plan and set things up in just a few taps.

Connect to your existing bank and start earning Points – No need to open a new account!

Hilton Honors

Debit Card

£60 annual fee

Welcome Bonus

Earn 2,500 Bonus Points¹ when you spend £1,000 in foreign currency within 6 months of getting your Card. Terms apply.

Earn up to 3 Hilton Honors Points for every £1 spent on eligible purchases.³ Learn more

Instant Hilton Honors Silver status.⁴ See Hilton Honors status benefits

Realtime Exchange Rate with low 0.5% FX fees.⁵ See our rates

Low 0.5% fee on ATM withdrawals abroad. 2.5% fee over £250 per month.

Earn 1 Hilton Honors Point for every 1p rounded up with Point Booster.⁶

Hilton Honors Plus

Debit Card

£150 annual fee

Welcome Bonus

Earn 10,000 Bonus Points when you spend £2,500 in foreign currency within 6 months of getting your Card. Terms apply.¹

Earn up to 4.5 Hilton Honors Points for every £1 spent on eligible purchases.³ Learn more

Instant Hilton Honors Gold status.⁴ See Hilton Honors status benefits

Complimentary daily continental breakfast or food & beverage credit.

Complimentary space-available room upgrades.

Realtime Exchange Rate with no FX fees.⁵ See our rates

Fee free ATM withdrawals abroad. 2.5% fee over £500 per month.

Earn 1 Hilton Honors Point for every 1p

rounded up with Point Booster.⁶

Not sure which plan is best for you?

Cardholder benefits

Enjoy instant status

Instant upgrade to Silver status with the Hilton Honors Debit Card, and to Gold Status with the Plus Card, to enjoy enhanced stay benefits.⁴

Earn Points

Earn Hilton Honors Points on your everyday eligible purchases³ and get up to 4.5 Hilton Honors Points per £1 when you spend in a foreign currency at Hilton properties.

Save on spending abroad

Save on international transactions with low to no FX fees.⁵ See our rates

Ways to earn Points

Everyday spending

Earn Hilton Honors Points on your

everyday eligible spending³, including

groceries, tickets, transportation, and

more.

Boosted Hilton Honors

Points

Earn up to 4.5 Points per £1³, when you

spend in a foreign currency at Hilton

properties abroad.

Refer Friends

Earn 1,000 Hilton Honors Points for

every friend you refer.

Ready to join?

Link to your bank

Connect your Hilton Honors Debit Card to your existing bank account. See banks we link with.

Earn Points as you spend

We debit your linked bank account when you spend, and you earn Points to redeem for stays and more from Hilton.

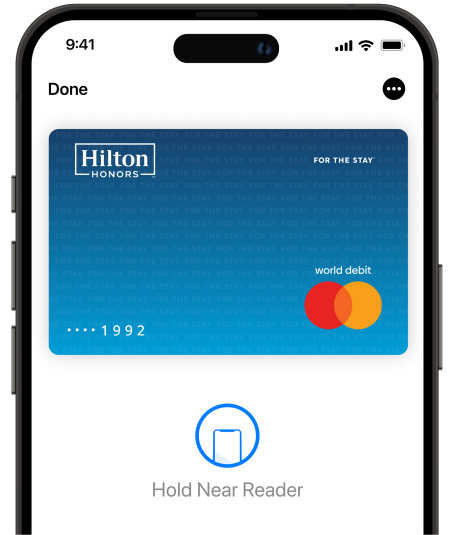

Works with Google Pay and Apple Pay

Works with Google Pay and Apple Pay

Secure for your peace of mind

Securely connects with your bank account

Protect your account with 2-factor authentication and location.

Covered by Mastercard purchase protection.

Freeze your Card if it’s lost or stolen.

Set Card spend limits to protect against misuse from fraud and theft.

Our dedicated customer service team is on hand to help.

Download the app to get started

Scan with your phone camera to get the app.

Download the app to get started

FAQs

Which banks do you support?

Hilton Honors Debit Card is integrated with the following UK banks:

Allied Irish Bank, Bank or Ireland, Bank Of Scotland, Barclays, Coutts, Danske Ban, First Direct, HSBC, Halifax, Lloyds, Monzo, Nationwide, Natwest, Revolut, Royal Bank of Scotland, Santander, Starling, TSB, Virgin Money & Ulster.

What exchange rate do I get when spending abroad?

Hilton Honors Debit Card - £60/year:

- Transactions: Realtime Exchange Rate with low 0.5% FX fees.

- ATM withdrawals: Low 0.5% FX fees on ATM withdrawals abroad. 2.5% FX fee over £250 per month

Hilton Honors Plus Debit Card - £150/year:

- Transactions: Realtime Exchange Rate with no FX fees.

- ATM withdrawals: Fee free ATM withdrawals abroad. 2.5% FX fee over £500 per month.

Who's eligible for a Hilton Honors Debit Card?

Before signing up for a Hilton Honors Debit Card, please make sure you meet following criteria:

- Be aged 18 or over

- Have a valid mobile phone number

- Be suitable for a payment card that uses a direct debit, and have no active County court judgments (CCJs)

- Have an active current account with one of the UK banks we support

- Be registered for and have access to online or mobile banking

What is the Point Booster feature?

Supercharge your Hilton Honors Points balance by rounding up your transactions to the nearest 10p, and we’ll convert the difference to Points.

You’ll earn 1 Point for every 1p rounded-up. E.g. A £25.05 transaction is rounded up to £25.10, so you’ll pay an extra 5p and you earn 5 extra Points

You can switch Point Booster on or off at any time.

Where will I not earn Points?

Hilton Honors Points are awarded for eligible transactions, which include final payments where the merchant completes the transaction, and your linked bank account is debited.

Points cannot be earned on the following transactions:

- UK or European taxes (e.g., HMRC, council tax)

- Rent or mortgage payments

- Card fees

- ATM cash withdrawals

- Financial product payments

- Cash recycling schemes

- Educational fees

- Cash advances disguised as purchases

- Transactions with retailers controlled by the cardholder

¹Welcome Bonus: Earn 2,500 Hilton Honors Points when you spend £1,000 in foreign currency within 6 months of ordering the Hilton Honors Debit Card, or 10,000 Points when you spend £2,500 in foreign currency with the Hilton Honors Plus Debit Card. Points will be awarded 14 days after the spend threshold is met. Offers may be withdrawn or amended at any time and are only valid on the offer available at the time of card ordering.

²Instant Status Upgrade: Hilton Honors Debit Cardholders receive Silver status; Hilton Honors Plus Debit Cardholders receive Gold status. Status begins on card activation and ends on cancellation or closure of account.

³Eligible Spend: See full terms for what counts toward eligible spend here.

⁴Realtime Exchange Rate: Hilton Honors Debit Card includes Currensea Realtime Rate + 0.5% FX fee. Hilton Honors Plus Debit Card includes Currensea Realtime Rate with no markup. Full details in our terms here.